What is PayCode®?

PayCode® is a unique new high frequency payroll payment processing system that can completely eliminate costly cheque payments to employees – even un-banked employees – saving time and money for both your business AND your employees.

PayCode® converts your cheque payments to electronic payments while providing your employees with easier, quicker and more convenient access to their net payroll funds, eliminating a trip to the nearest bank or ATM on payday, and avoiding the stress of a bank ‘hold’ on funds deposited by cheque.

- PayCode® Cash provides your employees with on-site cash payments of their net payroll funds, using our proprietary PayCode® Cash Kiosk/ATM.

- PayCode® eTransfer can provide your employees with same-day eTransfer payments direct to their bank accounts, initiated directly from your payroll system. PayCode® eTransfer uses the Interac® Bulk eTransfer payment system to process your payments without the need to login to your own bank’s online banking or online cash management systems.

Who uses PayCode®?

PayCode® Cash works particularly well for un-banked daily-pay temporary labour employees, providing them with instant access to cash funds as an alternative to taking a cheque to a 3rd party cheque-cashing service.

Employees with established bank accounts can choose to be paid by PayCode® eTransfer, providing them with same-day access to their net pay funds in their bank account.

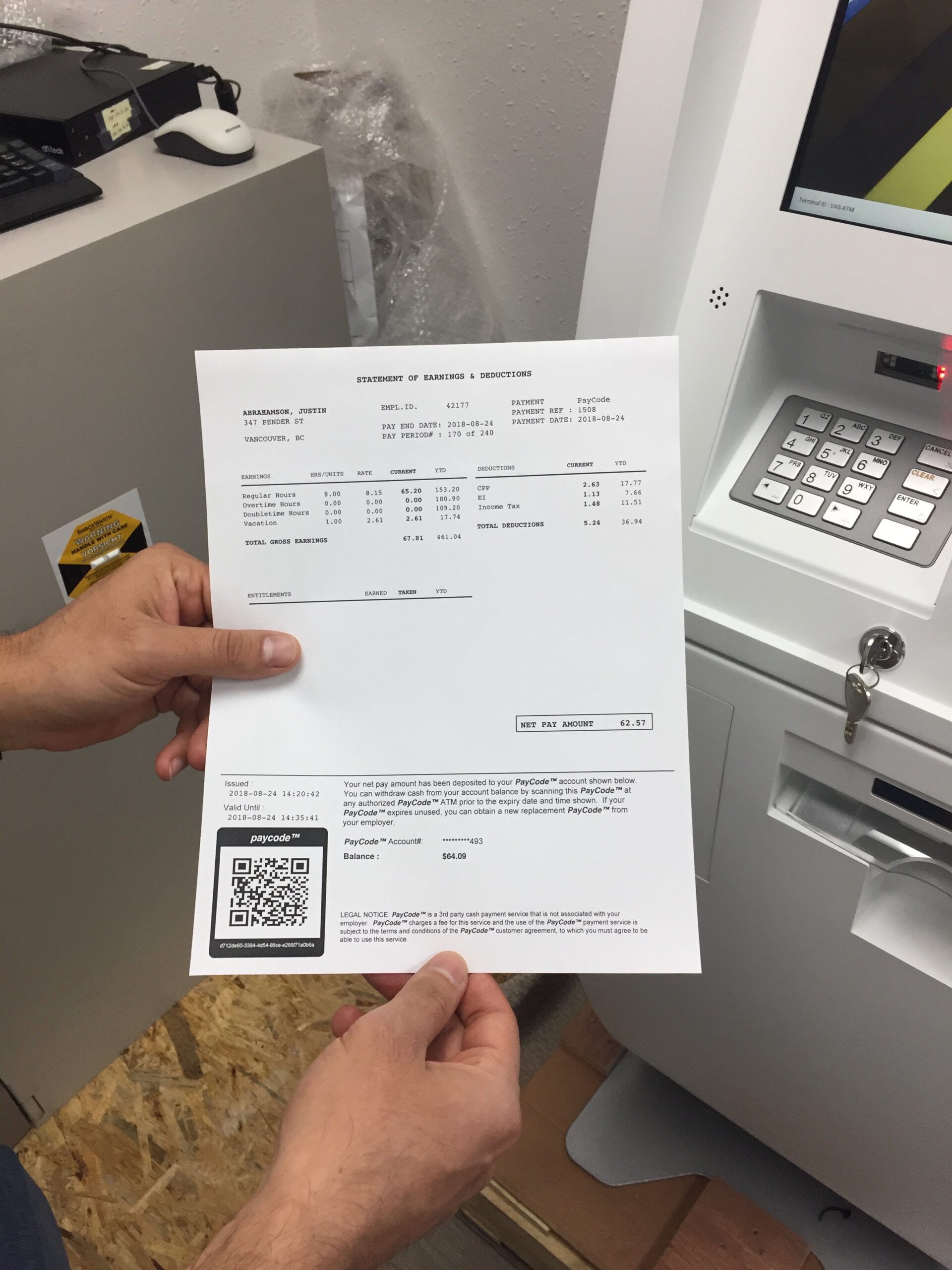

The PayCode Cash Kiosk/ATM

How does PayCode® Cash work?

PayCode® places a secure Kiosk/ATM at the employer’s place of business where your employees get paid. Instead of issuing a cheque payment to your employees, PayCode® Cash enables you to pay your employees their net pay as a cash payment dispensed from the on-site Kiosk/ATM.

Each PayCode® Cash payroll payment generates a unique one-time use QR code (aka “PayCode®“) that is printed on the employee’s payroll statement of earnings and deductions. The employee then simply scans the QR code at the PayCode® Cash Kiosk/ATM located at the branch, and instantly obtain cash funds for their net pay amount!

PayCode® Cash and PayCode® eTransfer have both been designed to integrate seamlessly with the ELF.online payroll system to quickly and efficiently transfer funds via a secure electronic transaction from a pre-funded employer PayCode® account to the PayCode® account of the employee, or to the Interac® Bulk eTransfer processing system.

Less time, Less cost, Real Value!

Imagine. No more printing and signing of cheques, no more telephone calls from 3rd party cheque-cashing services to confirm details of cheques issued to employees, no more monthly reconciliations of outstanding un-cleared cheques, no more stop payments on lost or stolen cheques, no more fighting with the bank over duplicate-paid cheques (e-Deposit + 3rd party cashed), no more costly and time-consuming ‘positive-pay’ cheque-clearing services required from your bank, no more ordering of costly pre-printed secure cheque stock, no more worrying about storing and securing access to pre-printed cheque stock, no more cheque fraud!

Empowering Business Key Feature

Pricing

Discover flexible pricing plans designed to meet your business needs, whether you're a small team or a large enterprise.

Request Demo

Experience our platform in action. Schedule a personalized demo with our experts today.

The economic benefit of adopting the ISO 20022 payment message standard in Canada

PayCode has replaced 85% of our payroll cheque payments to employees within the first year of implementation, resulting in annual cost savings measured in the tens of thousands of dollars at a single branch location.

Trades Labour Corporation

Features

- No client software installation required; PayCode is integrated with the ELF.online payroll system as an available payment method.

- No server software installation required; we provide fully-hosted and managed services using highly available and scalable Amazon AWS cloud servers and services.

- Employee signup is simple and fast - employees complete and sign a simple form to opt into PayCode payments, one click to create a new PayCode account for an employee from your ELF.online payroll system, then one click to pay them.

- Operate single branch or unlimited multiple branch PayCode Kiosk/ATM locations;

- Employees can be easily and quickly switched between alternative payroll payment methods;

- Configurable minimum and maximum PayCode payment limits and QR code expiry options;

- Pay employees one at-a-time or use the Payroll Wizard to generate batch PayCode payroll payments for hundreds of employees at once!

- Single branch or unlimited multiple branch locations.

- Capable of processing hundreds of daily payroll payments per branch.

- Benefit from reliability of enterprise-grade large-scale AWS cloud services.

- 99.9% guaranteed up-time service levels.

- Benefit from security of enterprise-grade large-scale AWS cloud services and infrastructure.

- Transactions processed securely over closed-loop private TLS encrypted network.

- Role-based user permissions for processing PayCode payroll payments.

- Kiosk/ATM equipment installed to bank-grade standards - anchored to floor and contained in securely locked armoured enclosure.

- Kiosk/ATM cash delivery & loading provided by fully-bonded armoured car service.

- PayCode is a custom product developed for the daily-pay temporary labour industry - it's features were created specifically for this industry, and not as a generic payroll payment system.

Pay your workers/employees in a flash. PayCode was developed for the daily-pay temporary labour business, providing you with lightning fast 'Post & Print' payroll processing for individual employees. We challenge you to find a faster payroll payment system - you won't find one.

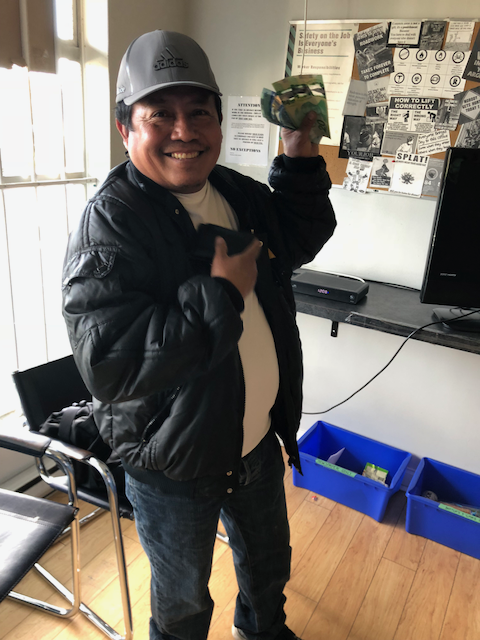

PayCode customers are happy and satisfied employees!

PayCode® is a registered trademark of PayCode Canada Corporation.

...the cheque costs between $2.00 and $3.85 more in its journey through origination, administration, reconciliation, clearing and settlement... versus electronic payment.